The Series E funding round will nearly treble the valuation of the San Francisco-based pure-play healthcare cloud company to $3 billion, the sources said.

A formal announcement is due within the fortnight. A small secondary round might also take place along with the primary infusion.

With this round, the six-year-old software as a service (SaaS) startup would have raised a little over $350 million across five financing rounds, similar to heavily funded SaaS peers from India such as Freshworks, Druva, Icertis, Postman and Zenoti.

When contacted, a spokesperson for Innovaccer said: “The company would not be able to comment on this news or confirm anything as of now.” Kaiser Permanente, Mubadala and B Capital did respond to ET’s emails till press time.

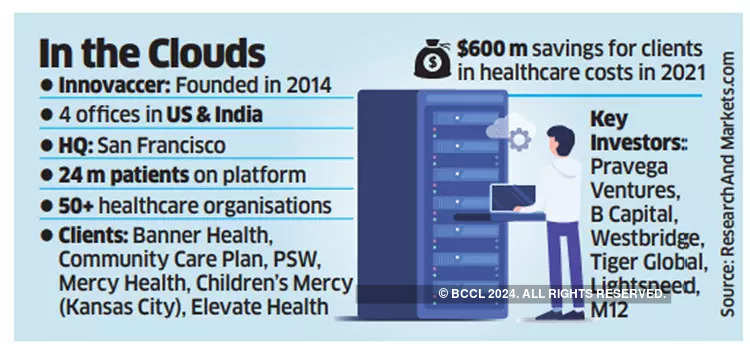

Innovaccer, founded by Abhinav Shashank and fellow IIT, Kharagpur campus mate Kanav Hasija and former Ingersoll Rand colleague Sandeep Gupta, has been aspiring to be a global healthcare-focussed SaaS company entirely on cloud. With seed money from former Google India chief Rajan Anandan and Pravega Ventures, the trio built a horizontal cloud data platform for US healthcare, a $1-trillion opportunity that was ripe for disruption.

Innovaccer’s cloud platform connects healthcare data culled from various sources, collates them in one place for easy access and then recommends actionable insights, resulting in better outcomes and lower costs. The company has set up engineering centres in Noida, Chennai and Bengaluru within a year, as the sector continues to draw big investments.

In February, the company raised $115 million at a $1.3-billion valuation – also about a three-times jump from the previous round seven months prior – from new investors like Omers of Canada as well as existing backers like Tiger Global, Dragoneer, Steadview Capital and Microsoft’s VC fund M12.

The healthcare cloud computing market has the potential to grow by $33.49 billion during 2021-2025, and the market’s growth momentum will accelerate at a compounded annual growth rate (CAGR) of 23.18%, according to some industry estimates. An October study by ResearchAndMarkets.com said revenue of the global healthcare cloud computing market is expected to reach $52.30 billion by 2026, from $11.59 billion in 2020, growing at a CAGR of 28.5% during the period.

The Covid-19 pandemic has made the need to digitise records even more important for care givers, insurers as well as patients.