Start Here: Build Your Financial Foundation

Learn the essential strategies for budgeting, saving, investing, insurance, and building passive income with our most important beginner-friendly guides.

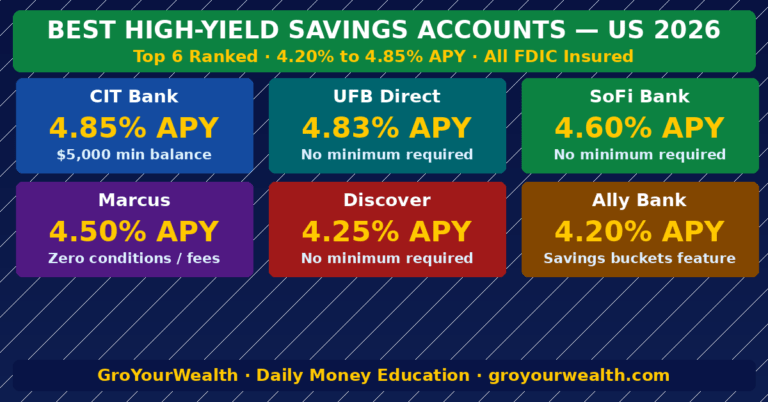

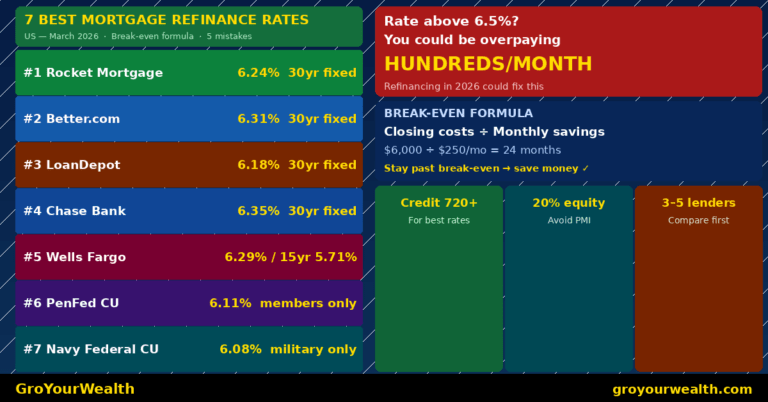

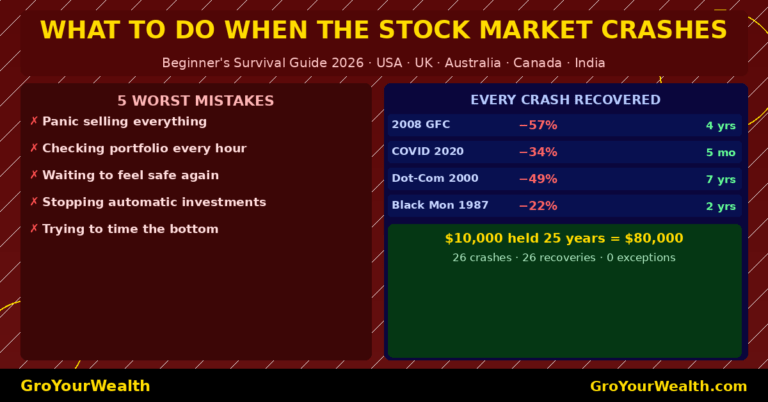

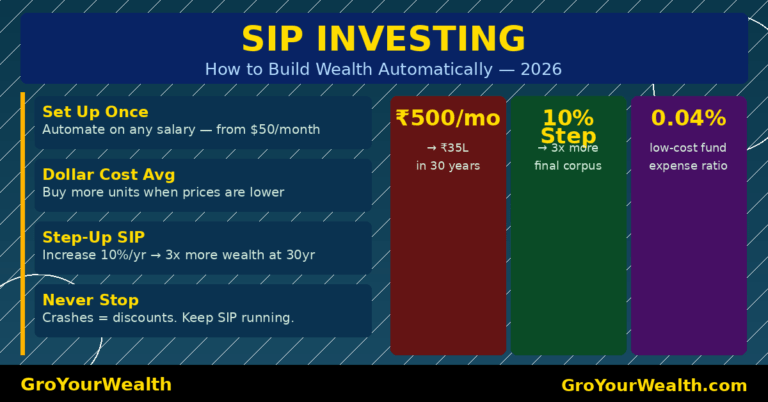

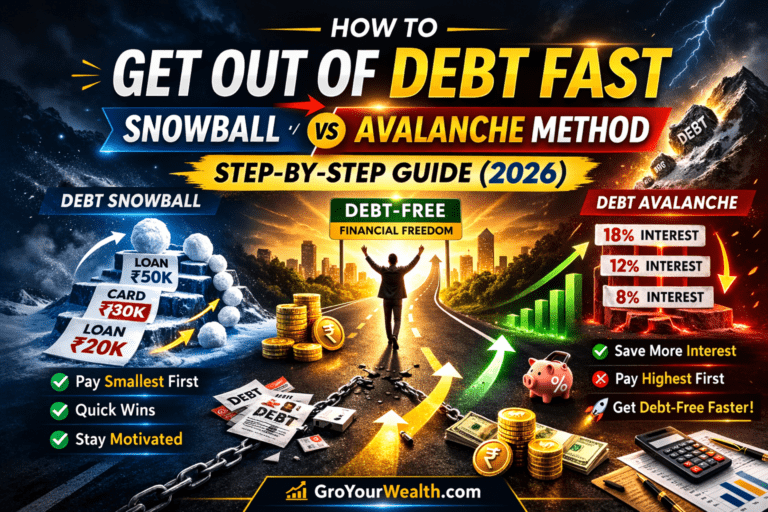

Finance & Investments

Personal Finance

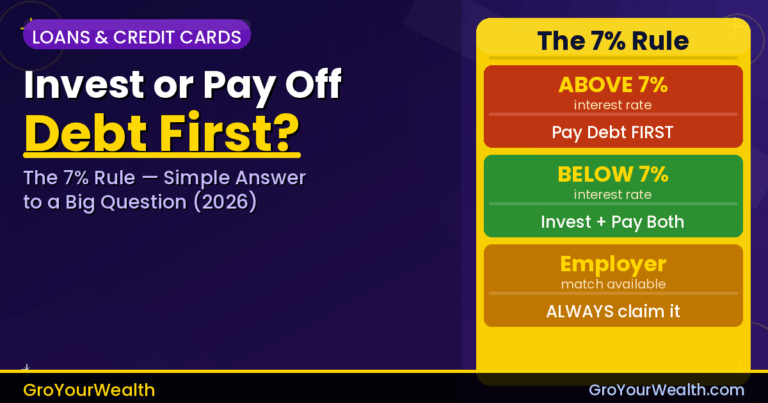

Loans & Credit Cards

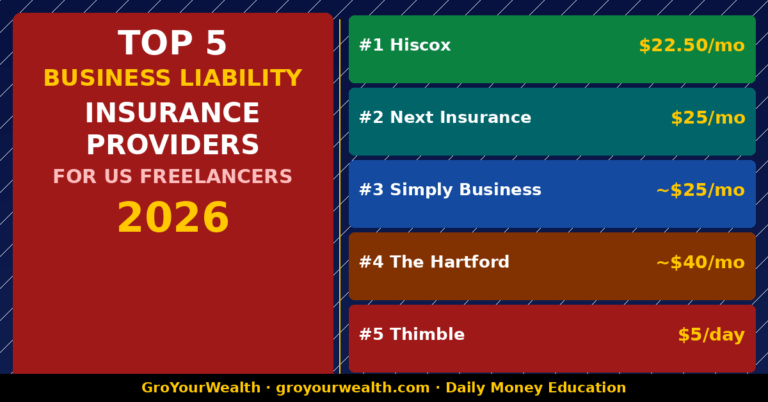

Insurance & Protection

Make Money Online

Tax & Retirement Planning

Why Trust Grow Your Wealth

Grow Your Wealth is an educational finance platform dedicated to helping readers make smarter money decisions through clear, research-based, and practical guidance. Our content focuses on budgeting, saving, investing, insurance, credit management, and long-term wealth building strategies designed for real-world financial stability.

All articles are written with the goal of simplifying complex financial topics into easy-to-understand insights so readers can take confident steps toward financial independence.

Disclaimer :

The information provided on Grow Your Wealth is for educational purposes only and should not be considered financial, investment, tax, or legal advice. Readers should consult a qualified professional before making any financial decisions.