With the purchase of Five9 for $14.7 billion, Zoom Video Communications is wading into a crowded contact center as a service market, but is betting that it can blend platforms and products like Zoom Phone to grab more enterprise wallet share.

The purchase of Five9 will give Zoom more heft in the enterprise and a way into the $24 billion contact center market. However, there are some huge players in that space already. Cisco, Avaya, NICE, Genesys, AWS and Twilio are all rivals in some way.

Oppenheimer analyst Ittai Kidron said in a research note:

Five9 will give Zoom access to an established sales organization and enterprise customer base that would have taken time and investment to build. We’re positive on the cross-selling opportunities the merger creates, as we believe Five9’s selling/go to market motion reaches a new and different buying center than Zoom currently reaches with its Zoom Meetings base (video) and growing Zoom Phone (voice) expansion.

Indeed, Zoom CEO Eric Yuan said Five9 is a natural fit that will help make it a broader customer engagement and communications platform. Yuan, speaking on a conference call Monday morning, said:

As we continuously look for ways to enhance our platform, Five9 is a natural fit that will enhance our ability to deliver happiness and value to our enterprise customers. At Zoom’s core, we believe robust and reliable communication technology can enable interactions that build a greater empathy and trust. So, we believe that holds particularly true for customer engagement. Enterprises primarily communicate with their customers through the contact center. This acquisition can bring together best-in-class video and contact center solutions to create a leading customer engagement platform that will redefine how companies of all sizes engage with their customers.

Rowan Trollope, CEO of Five9, said his company is looking to make customer service more human. The combination with Zoom will enable it to accelerate its mission and scale globally.

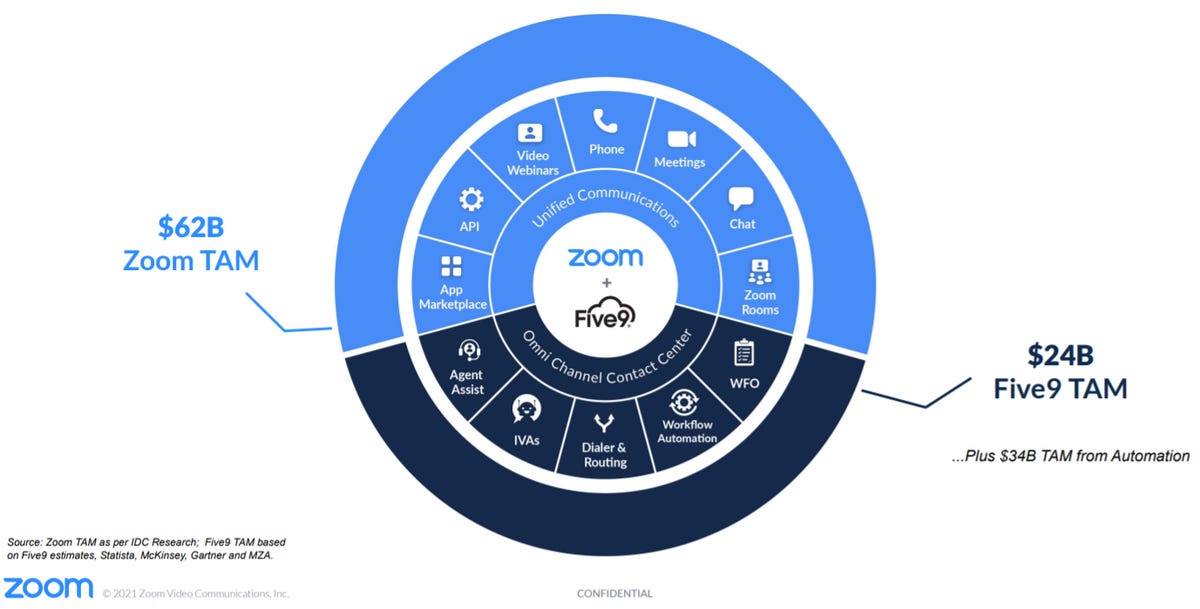

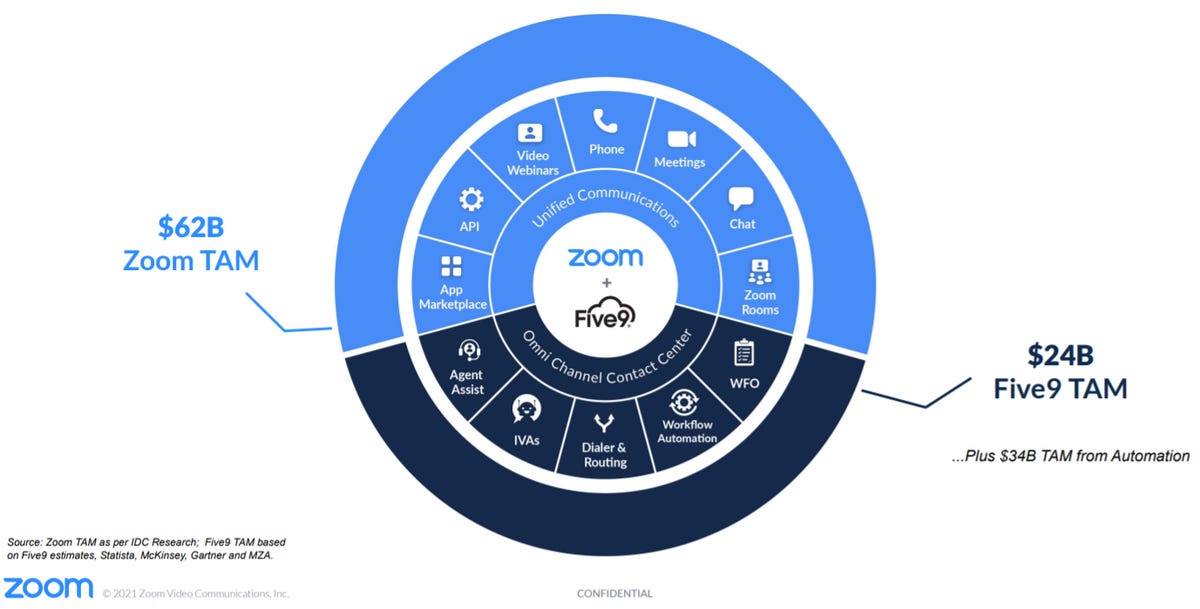

What the companies are hoping to do is develop an integrated communication and collaboration stack. Think suite meets best of breed. CFO Kelly Steckelberg said the contact center is the front door of customer engagement and Zoom with Five9 will be an omnichannel platform.

“The combination creates a leading unified communication and customer engagement platform that can be sold across both customer bases. It will allow us to cross-sell Zoom Phone to Five9 customers and bring the contact center to Zoom’s largest customers,” said Steckelberg.

Trollope said joint customers were increasingly looking to buy Zoom and Five9 together. “These large IT buyers, they really want a single communications platform,” said Trollope.

Build vs. buy

Stifel analyst Tom Roderick said the purchase of Five9 comes at a good time for Zoom. First, Zoom needed to prove it was more than a video conferencing company. Zoom also expanded with Zoom Phone, but the full contact center buildout would have taken years.

Roderick said:

Zoom is in need of emphasizing the opportunities beyond Video Conferencing. The year over year growth compares are already entering their toughest period for Zoom, and we think the combination of a “what’s next?” story alongside an inflection point for Zoom Phone makes the sizable combination quite appealing.

Zoom CEO Yuan said the decision to Five9 made sense over building a contact center platform because the cultures aligned, and the two companies already landed large deals together. “Otherwise, you build a solution, I think not only do you take many years’ effort, but also customer, they do not want to wait, right?” said Yuan.

Yuan added that Zoom’s approach to the contact center will continue to be neutral even with Five9. He said everything has to be viewed from the customer perspective and Zoom customers have deployed Genesys and Twilio and the company works with multiple vendors.

Trollope added that Five0 supports all unified communications players too.

Ultimately, Zoom bought Five9 because it wanted to double down on contact center and unified communications. “Look at our video assets, look at their AI and very robust back-end and we do see the huge opportunity ahead of us,” said Yuan. “I think that together, we can really create something very cool in the future to redefine the customer engagement platform.”