Bengaluru: Consumer stickiness, average order size increasing to $15-20 and the possibility of selling other healthcare services like online doctor consultation and diagnostics services have caught the interest of large strategic names like Reliance Industries and Amazon, driving them to the e-pharmacy sector.

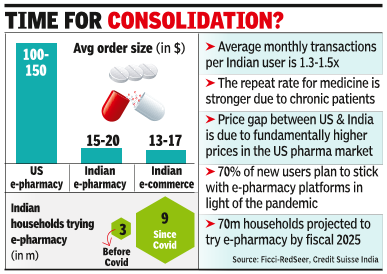

E-pharmacy had over 3 million users before the pandemic struck in India, according to a white paper from industry body Ficci and market research firm RedSeer, but added 6 million new customers since March. Industry executives said Reliance’s talks with Netmeds, which were on for at least six months, triggered the consolidation in the industry between two other established brands — PharmEasy and Medlife. The proposed merger came about after Medlife found it tough to raise capital from external investors.

“Our ecosystem was a crowded one and all the main four-five players were in the market to raise funds. Netmeds or Medlife were not able to raise from external investors and it reached a point that consolidation was inevitable. The ecosystem demanded there be fewer players and, on top of that, since Covid-19, digital health has become a top priority. So, the process got accelerated,” a top executive in the e-pharmacy industry said. The sector saw an investment of over $700 million in FY20, according to the white paper.

“What they (remaining players) are trying to do is build a break-even business here and then have a wider play on overall healthcare needs. So, this becomes a good customer acquisition channel, and then serve consumers with high gross margin products like a consultation and lab-test,” a former e-pharmacy entrepreneur said. According to him, medicine delivery platforms haven’t been able to top gross margin levels of 25-30%.

Ankur Pahwa, partner and national leader (e-commerce & consumer internet), EY India, echoed the views. “There is higher repeatability and retention for e-pharma, given the skew towards chronic ailments. Once on-boarded, customers tend to stay on even as discounts reduce over time. There is also the broader expansion into health tech around diagnostics, e-consultation, private labels, insurance, and wearables, which make it a larger opportunity,” he said. For most platforms, 60-70% of medicine order volumes are from chronic patients.

Top e-pharma founders and executives said, while online sales contribute just 3% of the total medicine market, the recent developments will have a lasting effect on the sector. This would include a gradual fall in discounts, which was 20-30% last year and is now already sliding towards 15%.