Introduction

For decades, retirement planning focused on a single concern:

saving enough money before leaving work.

But modern financial reality has introduced a different and often more dangerous challenge:

Outliving your savings.

This challenge is known as longevity risk—the financial danger that a person lives longer than their retirement resources can support.

Across developed and emerging economies, improvements in:

- Healthcare

- Nutrition

- Living standards

- Medical technology

are steadily increasing life expectancy.

While this is a remarkable human achievement, it also transforms retirement from a short rest period into a multi-decade financial phase.

Understanding longevity risk is now essential for anyone planning long-term financial security.

Why Longevity Risk Is Increasing Worldwide

Rising Life Expectancy

Global demographic data shows consistent increases in average lifespan.

Many retirees today may spend:

- 20–30 years in retirement

- Sometimes longer than their working careers’ early phase

This dramatically increases the amount of savings required.

Declining Traditional Pension Support

In many countries:

- Government pension systems face pressure

- Employer-guaranteed pensions are shrinking

- Individuals bear more responsibility for retirement income

This shift makes personal financial planning far more important than in previous generations.

Healthcare Cost Expansion

Longer life often includes:

- Chronic health management

- Long-term care needs

- Rising medical inflation

These factors increase total retirement spending beyond basic living expenses.

The Financial Impact of Living Longer

Longevity risk affects retirement in three major ways.

1. Savings Must Last Longer

A retirement fund designed for 15 years may fail over 30 years.

Time alone can double the required financial resources.

2. Inflation Becomes More Powerful

Even moderate inflation can significantly reduce purchasing power across decades.

Maintaining some growth-oriented investments becomes necessary, even after retirement.

3. Withdrawal Mistakes Become Dangerous

Poor withdrawal planning early in retirement can permanently damage sustainability.

This connects closely with disciplined financial behavior described in money psychology and long-term habit formation.

Sequence of Returns Risk and Longevity

One of the most overlooked retirement dangers is sequence risk:

- Market declines early in retirement

- Combined with withdrawals

- Permanently reducing portfolio recovery potential

Emotional reactions during volatility—explained in market psychology and investor behavior cycles

can worsen this effect if retirees panic and sell assets.

Longevity risk amplifies sequence risk because mistakes must last for decades.

Core Strategies to Manage Longevity Risk

1. Diversified Retirement Income Sources

Relying on a single source—such as savings alone—creates fragility.

Stronger plans combine:

- Investments

- Pensions

- Annuity-style guaranteed income

- Part-time or flexible work

Multiple income streams reduce the chance of complete depletion.

2. Flexible Withdrawal Planning

Rigid withdrawal amounts ignore:

- Market performance

- Inflation changes

- Health expenses

Adaptive withdrawal strategies help retirement funds last longer.

3. Maintaining Growth Exposure in Retirement

Avoiding all investment risk may feel safe,

but excessive conservatism increases the danger of running out of money.

Balanced portfolios allow:

- Continued growth

- Inflation protection

- Longer sustainability

This reflects disciplined allocation principles similar to those used in interest-aware long-term financial planning, where time and compounding shape outcomes.

4. Delayed Retirement When Possible

Even a few additional working years can:

- Increase savings

- Reduce withdrawal years

- Boost pension benefits

This is one of the most powerful longevity defenses.

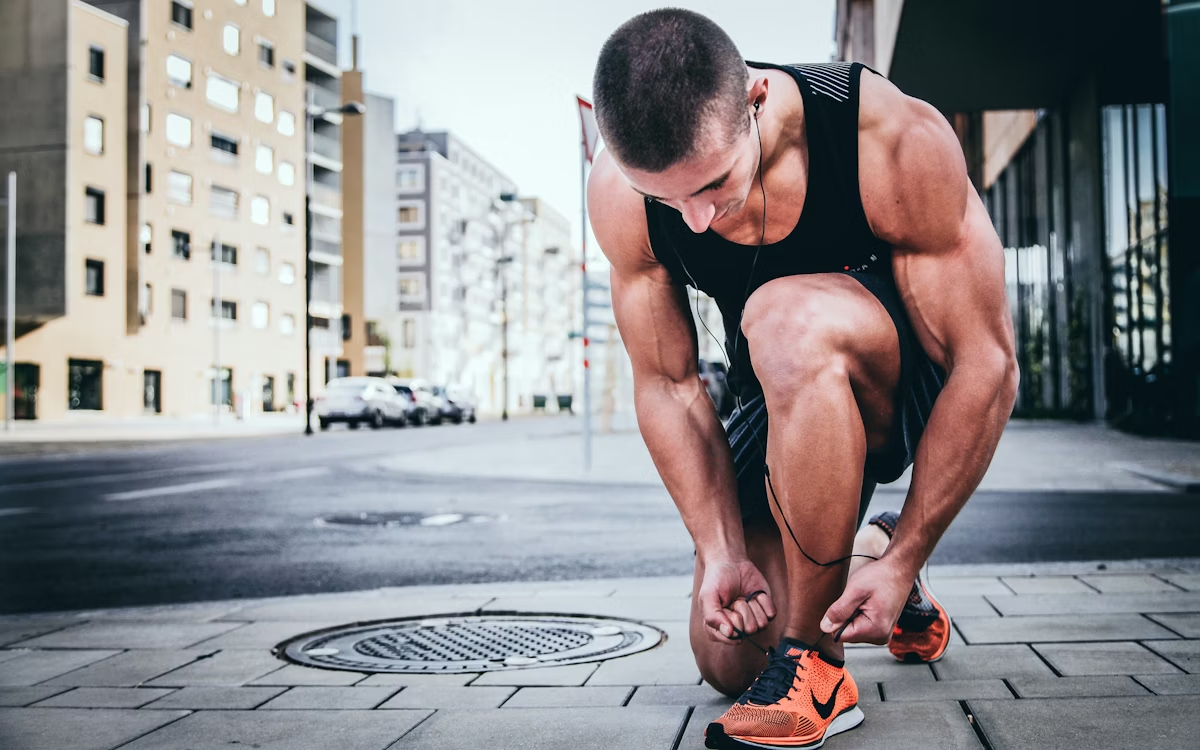

5. Health Planning as Financial Planning

Healthy aging reduces:

- Medical expenses

- Dependency risk

- Long-term care costs

Financial security in retirement is therefore partly influenced by

lifestyle and preventive health choices.

Psychological Challenges of Long Retirement

Longevity is not only financial—it is emotional.

Retirees may face:

- Fear of overspending

- Anxiety about market volatility

- Uncertainty about lifespan

Structured planning reduces stress and supports confidence, just as protection planning stabilizes families in family financial safety and risk management.

Global Policy Attention on Longevity Risk

International institutions increasingly study aging populations.

Research from the Organisation for Economic Co-operation and Development retirement outlook

highlights:

- Rising dependency ratios

- Pension sustainability concerns

- Need for individual retirement preparation

Longevity risk is therefore not just personal—

it is a global economic transformation.

Turning Longevity Into an Opportunity

Living longer is not only a risk.

With preparation, it becomes a chance for:

- Extended personal freedom

- Multi-phase careers

- Continued learning and contribution

- Meaningful late-life productivity

Financial planning enables longevity to feel like time abundance,

not financial pressure.

Conclusion

Retirement planning is no longer about reaching a finish line.

It is about funding an entire additional life stage.

Longevity risk transforms retirement from a short period of rest

into a decades-long financial journey.

By combining:

- Diversified income

- Flexible withdrawals

- Growth-aware investing

- Health and lifestyle planning

individuals can convert the uncertainty of long life

into lasting financial security and peace of mind.