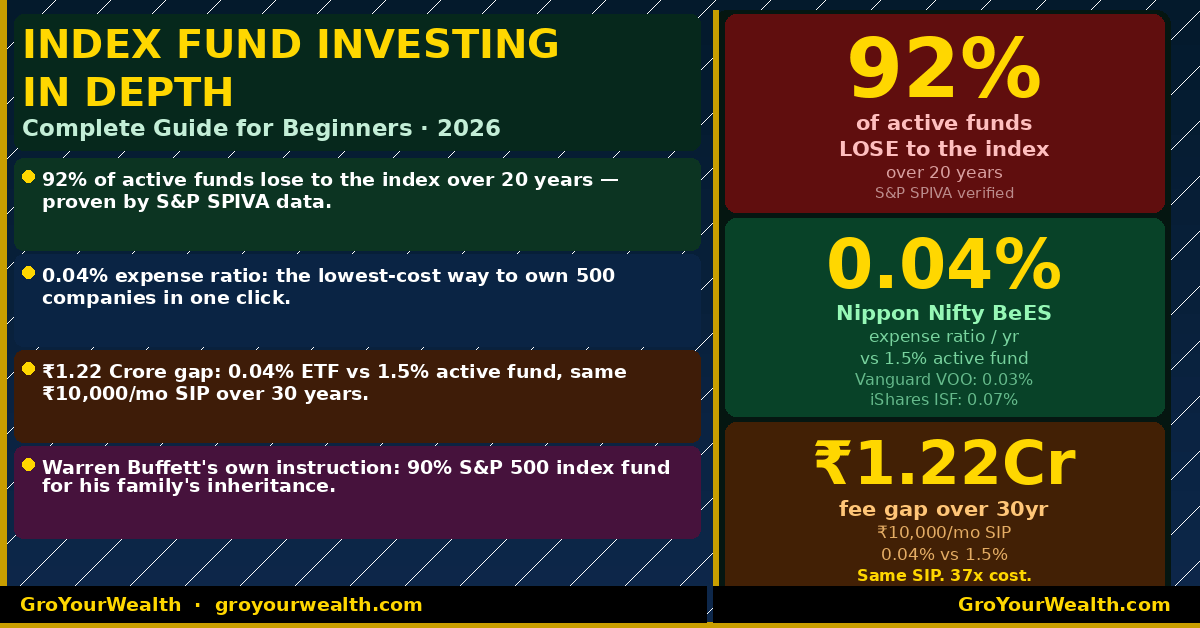

Index Fund Investing in Depth — Complete Guide for Beginners 2026

What you will learn: What an index fund is, why 92% of actively managed funds lose to it over 20 years, how the expense ratio is quietly eroding your wealth, the 3-fund portfolio for India, and the Warren Buffett approach adapted for Indian investors — with real numbers and India-specific ETF picks. Watch the full … Read more